The digital-first approach has completely remodelled the Indian banking sector. From street vendors to business owners, access to digital payments is now just a tap away.

And the next big leap in Digital India is the widespread adoption of voice AI interfaces.

According to a survey, approximately 18 crore Indians lack basic literacy skills. This is the main reason why built-in voice assistants are gaining popularity and transforming the banking experience.

Features like multilingual support and easy access to information on interest rates, collateral, and more. Voice-based banking for low-literacy users is breaking down long-standing barriers.

The fact that almost every Indian owns a smartphone has simplified the adoption of voice AI. Citizens who once hesitated to deal with bank clerks are now confidently processing loans through mobile apps.

The benefits of voice AI agents in banking are endless.

In this blog, we’ll explore the rise of voice AI in Indian banking sector and the key use cases driving this transformation.

What is the Current State of Voice AI Interfaces in Indian Banking?

Leading financial institutions, such as ICICI Bank and Union Bank of India, have already introduced voice search banking commands into their operations.These assistants are capable of:

-

Opening a Fixed Deposit Account

-

Bank Balance Enquiry

-

Transaction History

-

Credit/Debit Card Block

-

EMI Payments

-

Checking Loan Statements

The implementation of voice-enabled banking interfaces is still in its early stages of development.

Which means there’s still a lot to uncover.

As of 2025, voice AI assistants are highly advanced, with capabilities like multilingual support and voice sentiment analysis. These features make them well-suited for a linguistically diverse country like India, where languages change every 50 to 100 kilometers.

How Is Voice AI In Banking Transforming Financial Services?

Banks are overwhelmed with a vast amount of data and frustrated customers. In this situation, manual call handling doesn’t serve the purpose.

Luckily, we have an efficient alternative that saves cost, time, and talent.

Here are the three main reasons why your financial institution needs a voice AI agent:

-

Speed

Voice AI agents are trained to solve a purpose. They can handle routine queries, reduce wait time, and address context-specific issues.

Agentic voice assistants go as far as helping users navigate the loan approval process by overcoming the complexities of manual documentation.

-

Accuracy

AI voicebots run on predefined conversational paths. They maintain a consistent tone across all promotional channels and adhere to government regulations to avoid penalties and violations.

-

Security

The banking sector relies on data security. Voice AI agents secure user trust by maintaining a two-way encrypted communication channel and voice biometric authentication to ensure sensitive information remains protected at all times.

AI Voicebots in Banking: A Real Example for Each Use Case

AI in banking creates tangible value through personalization, fraud detection, improving customer experience, and human-like conversations. These developments represent the early phase of voice-first AI banking in India.

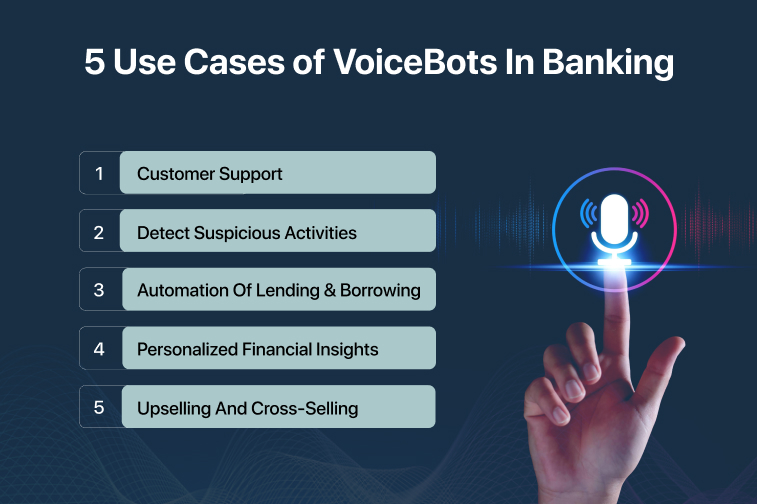

So, here are five practical voicebot use cases in Indian banks:

-

Customer Support

Imagine an organization workflow where human agents are only engaged in high-value tasks that directly impact profitability.

Well, let’s just say you don’t have to imagine it anymore.

With the ability to make instant judgments, AI voicebots in customer support can resolve day-to-day user queries, as well as provide in-depth assistance on loans, interest rates, and EMIs, thereby eliminating the need for time-consuming follow-ups.

-

Detect Suspicious Activities

The digitization of the banking sector has increased the risk of cybercrime, where people find innovative ways to trick the system. In this scenario, voice bots can easily review records to flag calls that match the exact phrases and keywords.

With the help of a technique known as voice sentiment analysis, voice AI assistants can easily identify the emotion behind a user’s speech.

-

Automation of Lending and Borrowing

A significant portion of the population remains unclear about how to apply for a loan, resulting in hesitation and missed opportunities. At the same time, existing customers need timely reminders about interest payments, credit card limits, and other essential details.

Reaching out to a bank official for such routine queries can be time-consuming and inconvenient. Voice enabled payments in India offer instant support to assist users anytime, anywhere.

-

Personalized Financial Insights

Outdated banking apps fall short on one of the most critical features: personalization. Every user has different investment needs, personal goals, and therefore a demand for tailored financial insights.

Voice AI bots have access to user profiles, past transactions, and customer preferences, allowing them to adjust their tone accordingly and provide context-specific financial information.

-

Upselling and Cross-selling

Customers choose the best option from a wide range of services. Take credit cards, for example. There are various types, such as cashback cards, travel rewards cards, fuel cards, and premium lifestyle cards, each with its own benefits.

These questions pop up instantly in a user’s mind, and nothing is more convenient than having a voice assistant ready with instant answers. Additionally, these assistants can perform everyday tasks, such as checking balances or completing voice transactions via UPI.

The journey to becoming voice-first is full of potential, but choosing the right partner can be a challenge. Here is a curated list of the best AI voice app development companies to help you decide.

Challenges in Implementing Voice Banking

Many companies build voice agents and discover their complications and hurdles post-launch. This gap leads to increased costs and user frustration.

Here are some challenges of voice AI in Indian banking:

-

Compliance Issues

Voice AI assistants should adhere to data privacy laws, such as the IT Act and the Digital Personal Data Protection Act, which have been implemented by the Reserve Bank of India and the Government of India.

If your voice assistants fail to meet the standards, it’ll result in penalties and a loss of customer trust.

-

Overcomplicated Features

A voice assistant that promises to solve everything delivers nothing. Building a voice assistant for a compliance-heavy sector like banking starts with a strong foundation.

Bundling multiple features into a voice assistant increases context dependency that ultimately leads to misinterpretation.

-

Inefficient Data Sets

Voice assistants are only as effective as the data they rely on. In the financial sector, where policies and regulations frequently change, it's crucial that voice AI systems continuously evolve with up-to-date, accurate data to remain reliable.

Revolutionize The Banking Sector With Infutrix

Infutrix is an emerging voice app development company with hands-on experience in building custom voice-enabled banking interfaces. Here’s what our voice agents can do:

-

Tailored to Company Needs: Designed to meet your specific business goals, workflows, and customer engagement strategies.

-

Multilingual Voice Banking: Communicate in multiple languages, enabling global reach and improved customer satisfaction.

-

Tested and Ready-To-Market Voicebots: Quality-tested and ready for deployment, minimizing setup time and maximizing ROI.

Voice-first AI banking India is enabling banks to enhance customer engagement, reduce operational costs, and expand their customer base.

Ready to witness our Voice Agents in action. Get in touch today!

FAQs(Frequently Asked Questions)

1. What industries are using voicebots the most?

The top industries that use voicebots are healthcare, banking, edtech, and hospitality. Their growing popularity in these sectors is driven by the ability to deliver personalized experiences to users. Know more.

2. Why are voicebots important for the banking sector?

The efficiency of a financial institution relies on its availability. Voicebots address the issue by providing round-the-clock support, reducing the workload on employees, and ensuring consistent customer service.

3. Which Indian bank uses AI voice?

Banks such as IndusInd, Kotak, ICICI, Union Bank of India, and Axis Bank utilize voice chatbots to handle routine queries, reduce customer churn, and streamline daily workflows.